is an oversold stock bad

Benefits of RSI. The stockprice to dip below the fair value.

Oversold Check Insider Buying Check Momentum Check

The main benefit of RSI is that it gives indications of when a market is overbought or oversold.

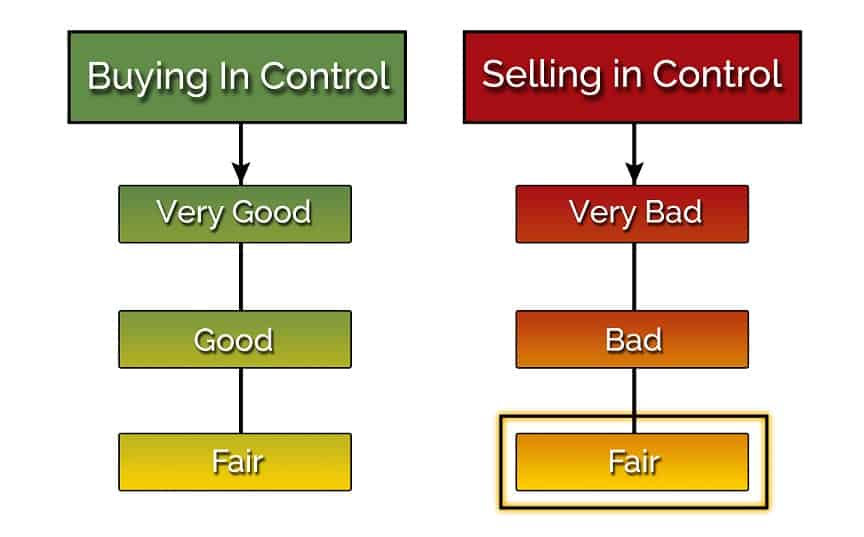

. When a stock is oversold the implication is that selling has pushed the price too far down and a reaction called a price bounce is expected. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good. On its own this doesnt suggest negativity but tells you the uptrend has been strong.

When a stock is oversold parties offer the stock beyond the fair value the true value is hard to gauge because everyone calculates differently. Cramer says stocks are still badly oversold even after Wall Streets big rally Published Thu Dec 2 2021 708 PM EST Updated Thu Dec 2 2021 745 PM EST Matthew J. Investors will get a bonus of up to US015 per share per quarter.

On its own this doesnt suggest negativity but tells you the uptrend has been strong. When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot - thats it. It also presents a possible opportunity for making gains.

RSI stands for Relative Strength Index. As the market is always right there are factors not known to everyone causing. The stocks that arrived at the lower price point are no longer equal to their original value.

Although oversold is mostly used when analyzing stocks and equities it can be used to describe other markets that share the mean-reverting traits of the stock market. In 2021 the company gave investors a total of US042 in extra payouts above the US036 base dividend. Usually an RSI below 30 indicates an oversold stock.

When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot thats it. A big company might be about to release bad news that would hurt its share price. Put simply it trades at a price thats much lower than it should.

Barrick Gold is also. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good. Theoretically an investor might see excellent trading results by doing nothing other than only buying stocks with an RSI of 20.

As opposed to overbought oversold means that stock prices have decreased substantially. An oversold condition can last for a long time and therefore being oversold doesnt mean a price rally will come soon or at all. While it is possible that an extremely overbought or oversold stock will become even more overbought or oversold such an outcome becomes increasingly unlikely the further to the extremes the RSI reaches.

Why Stocks are Overbought and Oversold. Another scenario is when large buyers take out stop orders before the subsequent repurchase at a better price. You can buy the stock and sometimes see quick returns as it rebounds.

A stock can become undervalued as a result of a major sell-off. Fundamentally oversold stocks or any asset are those that investors feel are trading below their true valueThis could be the result of bad news regarding the company in question a poor outlook for the company going forward an out of favor industry or a sagging overall market. This can happen for many reasons such as.

Why does a stock become oversold. When a stock becomes oversold though its a good thing for new investors. Many technical indicators identify oversold and overbought levels.

The opposite of an overbought stock is an oversold stock. This is critical for avoiding reversals and losing out on your investment. This means that its.

If a stock is oversold it means that the number of sellers outweighs the number of buyers. This is good for some bad for others or even neutral. Suppose a stock value suddenly falls because of issues in the company bad reports or any mass withdrawals of traders believing that the stock may be overpriced.

This as the name implies reflects a stock that appears to be worth more than the price it is trading at. Its especially useful in short-term investing where traders can take advantage of. Was even more oversold at the time as the stock was at an RSI level of just 26.

Oversold refers to a market state when prices have gone down excessively and therefore are likely to reverse to the upside in the near future. The share price would go on to rise from under 36 up to a. When a stock is oversold it trades at a price below its intrinsic value.

Traders and investors need to identify the reasons of such price decline in order to. It does mean however that the stock may not be a good value at that price. When analysts state that a stock is overbought it does not mean that the stock is a bad stock.

As a result investors sell shares before the news comes out and the price falls. Generally an oversold stock suffers from overreacting traders.

Which Is The Simplest And Best Indicator To Know That The Share Is Overbought Or Oversold Quora

Oversold Stocks Intraday Marketvolume Com

5 Oversold Stocks Ready To Rebound Thestreet

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Overbought Vs Oversold And What This Means For Traders

Market Oversold The Best Way To Tell If The Market Is Oversold

Oversold Stocks In 2022 Learn More Investment U

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

How To Find Oversold Stocks Meaning Indicators And Examples

Overbought Vs Oversold And What This Means For Traders

Overbought Stocks Discount 53 Off Www Pegasusaerogroup Com

Determining Overbought And Oversold Conditions Using Indicators

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Oversold Stocks Most Oversold Stocks Today

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)